- Home

- Technical Products

Enterprise Cloud IT Solutions

Test Measurement

Industrial Measurement

- Solutions

Enterprise Cloud IT Solutions

Test Measurement

- Latest Articles

- About Us

EN

EN

Redis Enterprise Financial Solutions

Extreme Financial Data Engine

Deep Customer Connectivity x Intelligent Risk Control x Compliance Protection

As digitalization sweeps through the financial industry, Redis Enterprise is a revolutionary data platform that helps organizations transform themselves. Not only do we help build real-time transaction systems and smart mobile banking solutions to help organizations meet the requirements of the Open Banking ecosystem, but we also turn compliance advantages into competitive advantages through millisecond response and multi-level security.

Rebuilding the Financial Data DNA for Speed

The New Crown Epidemic is radically reshaping the financial consumer landscape, and new research from BDO reveals that 43% financial decision makers are accelerating their digital transformation programs, with customer experience upgrades at the top of the strategic list.

In an era where speed is king, is your data platform ready to take on the challenge?

In an era where speed is king, is your data platform ready to take on the challenge?

Customer Experience Moment of Truth

In the future financial battlefield dominated by microservices and cloud-native architectures, the traditional data layer has become a hindrance to development. Redis Enterprise brings three core breakthroughs:

√ Real-time processing of billion-dollar concurrency

√ Intelligent Data Model Matrix

√ Full Scene Compliance Shield

"From e-commerce payments to card-issuing banks, Redis has allowed us to grow our business exponentially while maintaining the ultimate experience. It's not just a technological innovation, it's an evolution of the business model! - Kipp

Ltd. CTO Nir Levy

Smart Financial Scenarios

Business Applications

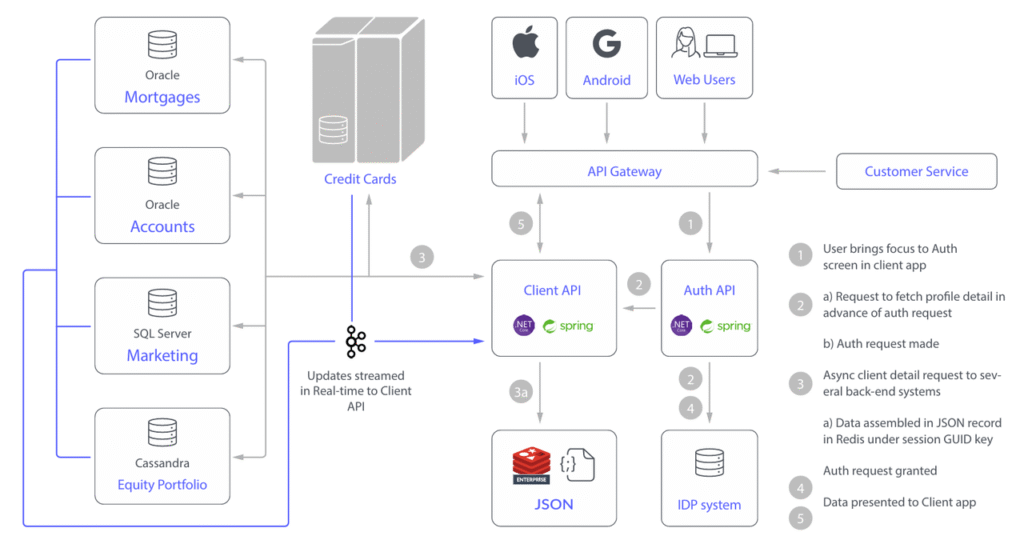

Smart Mobile Banking Platform

Redis Enterprise provides tens of millions of TPS writes and multimodal data support to instantly build a 360° customer profile. From accurate recommendation to intelligent risk control, and from sensorless login to wealth dashboard, it creates a 24/7 personalized financial service experience.

Real-Time Decision Command Center

Aggregate data streams in multiple dimensions such as sentiment indices, geospatial, regulatory documents, etc., and refresh trading strategies and risk control models in milliseconds. Keep every decision on the beat of the market.

Open Banking Ecological Engine

PSD2 to BIAN standard coverage, serverless architecture and MACH system are deeply adapted. With sub-millisecond data exchange capability, we can help you seize the first opportunity in the open banking mega market.

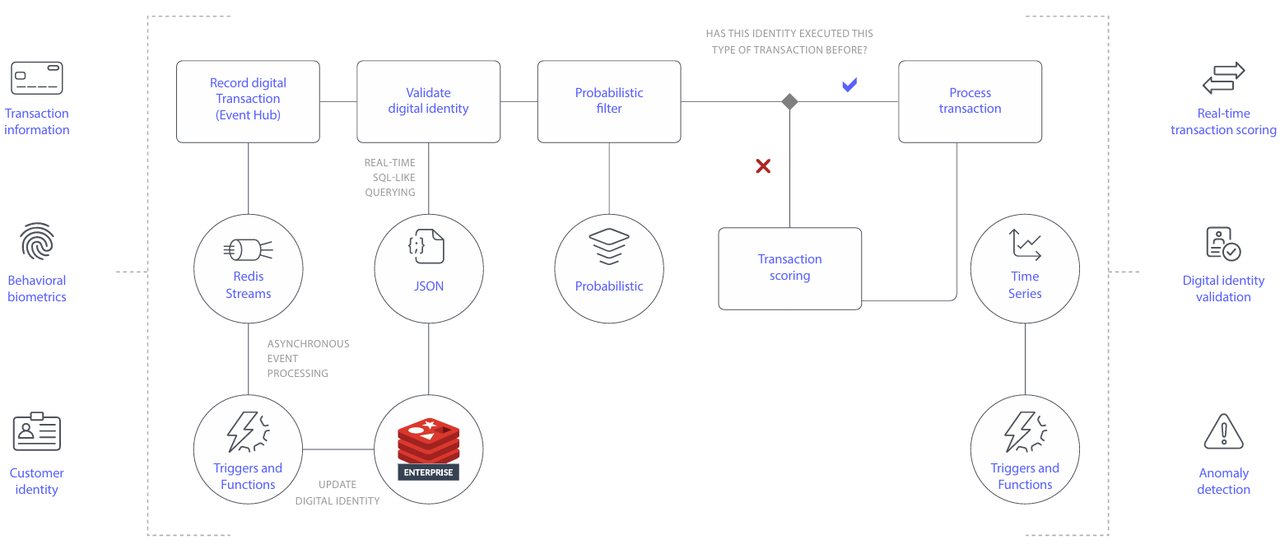

Intelligent Anti-fraud Matrix

When decentralized architecture meets AI black technology: real-time transaction image × geographic fence tracking × fraud pattern prediction. Every abnormal transaction can be hidden from view, and the safety of funds can be protected within milliseconds.

Intelligent Risk Control Hub

Redis Enterprise helps financial institutions achieve KYC compliance automation, high-frequency risk scanning, and granular permission control. In the new normal of remote office and open ecosystem, it builds a dynamic risk defense wall.

Technology Enabling Scenarios

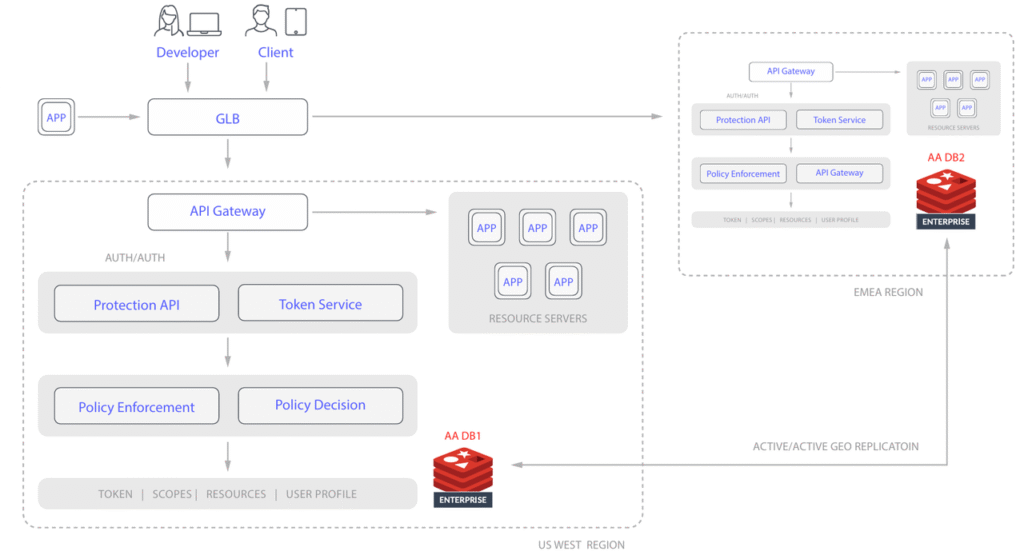

Extreme Cache Engine

Replacing traditional disk database queries with in-memory caching of high-frequency data, Redis Enterprise provides an enterprise-class caching solution with support for expiration/elapsed policies and Active-Active synchronous replication across multiple regions, enabling near-infinite scalability and lightning-fast data flow.

Real-time analytics acceleration

As a memory query gas pedal, Redis Enterprise supports pre-sorting of mainstream data structures, performs dynamic querying on millions of records with sub-millisecond latency, and empowers real-time decision making that leaps from minutes to breaths.

Conversation Management

When storing user session data, Redis Enterprise supports very large datasets with Redis on Flash, which provides data persistence options without performance loss, so the mobile experience is always on.

High Performance Document Storage

RedisJSON is a high-performance NoSQL file store that enables developers to build modern financial applications. Native APIs enable writing, indexing, querying, and full-text fuzzy searching of millions of JSON files per second, with response times below 1 ms, redefining the NoSQL speed standard for financial-grade file databases.

FinTech Proprietary Solutions

Millisecond Customer Experience Guarantee System

Intelligent Enhancement of Securities Trading Data

Real-time financial risk analysis

Case Management and Reporting Cost Optimization

Zero Trust with Fine-Grained Access Control

Full-end support for AI feature engineering

Real-time analytics delivery

Core Strengths Matrix

Building a software-driven financial services back office

Intelligent Data Center

√ RediSearch: millisecond fuzzy search

√ RedisGraph: Deep Relationship Graph Analysis

√ RedisBloom: Billion-Dollar Data De-Duplication and Filtering From anti-fraud to intelligent investment, data potential is fully activated.

Global Data Grid

CRDT technology enables real-time synchronization across continents, creating a borderless financial services network. With support for global level fraud detection, rate limiting and personalized scenarios, there is always zero time lag between data in New York, London and Hong Kong.

Guarding decentralized data security

Financial Security Fortress

Five-dimensional protection system: access rights isolation × encrypted transmission × multi-AZ disaster recovery × automatic failover × auditing and tracking. Compliance becomes a competitive advantage.

Fault tolerance, resilience and high availability No shared cluster architecture, supports process-level/node-level/cross-availability automatic failover, adjustable persistence and disaster recovery solutions.

FAQs

What is the Financial Services Data Model?

Data modeling is the process of storing data in a structured form in a database. Through data modeling, financial institutions are able to make data-driven decisions and achieve diverse business objectives. Common types of data modeling include relational, network, hierarchical, and object-oriented.

What is NoSQL Database for Financial Transactions?

NoSQL databases (i.e. "not only SQL") use non-tabular form to store data, which is different from relational databases. Based on the difference in data models, NoSQL databases are categorized into four main types: file-based, key-value, columnar, and graph databases. With flexible schema design capabilities, they can easily cope with industry scenarios such as financial services, where data volumes are huge and user loads are high.

How are databases used in the banking industry?

The banking industry utilizes databases to store and process data for financial transactions, including customer account management, balance tracking, deposit processing, and asset management, lending and credit card operations. Bank websites and mobile applications use databases to store content, customer login information and preferences, and support persistent storage of user input data. The database provides an efficient data storage solution for front-, middle- and back-office operations. As banks transform digitally, migrate to the cloud, and adopt new technologies, the choice of database type and vendor becomes increasingly critical.

What is Data Management and why is it important?

Data management refers to the process of collecting, storing, organizing and maintaining data assets in an enterprise. Efficient data management is the cornerstone for deploying business applications and analytics systems that provide operational decision support and strategic planning for management, business people and other end users.

What is Open Banking?

Open banking is the practice of opening up consumer bank accounts, transaction records and other financial information to third-party financial institutions through APIs. This model supports interoperability of accounts and data across organizations, serving consumers, financial institutions and third-party service providers.

What is Real-Time Analysis?

Real-time analytics allow users to visualize, analyze, and gain insights the moment data enters the system. By applying logic and math, the system outputs the basis for decision making in real time. Compared to batch analytics, real-time analytics requires extremely low latency (sub-millisecond) and high availability (e.g., 99.999%).