【虹科方案】從被動防禦到主動預防:用 KnowBe4 輕鬆應對關鍵基礎設施條例風險評估與審核

KnowBe4 為企業應對香港《關鍵基礎設施保護條例》提供了化繁為簡的解決方案。面對第 24 條與第 25 條的嚴格挑戰,它將難以量化的「人為風險」轉變為可追蹤的實戰數據,不僅彌補了傳統評估的盲點,更為年度審核提供了證明控制措施「有效運作」的鐵證。透過自動化報告與持續演練,企業能在大幅降低安全風險的同時,輕鬆滿足監管要求,實現從「被動合規」到「主動防禦」的關鍵轉型。

Abstracts:

This article focuses on the digital transformation of the financial industry. Fintech companies and Internet giants are capitalizing on cutting-edge technology to transform the financial industry.Reinventing the Customer ExperienceThe digital transformation of the financial services industry is being driven by the need to improve the quality of the services provided by banks. At present, most bank customers have already become accustomed to using digital channels.Older systems are a major obstacleThe customer is interested in theReal-time Service ExperienceWith the rising demand for new technologies, practitioners are well aware of the need for transformation.Overhauling the technology architecture, including the data layerThe

Looking ahead, financial services should realize real-time interactive experiences, reorganize core business processes, and accelerate cloud deployment.Redis Enterprise This can be empowered withExcellent performance, high availability and scalabilityand provideDiversified Data Modelingto support different application scenarios. Relying on the cloud database architecture, it can efficientlyAccelerate new product launchesIt has been proven to be effective in a number of successful cases.

Fintech startups and Internet giants are using cutting-edge technologies toReinventing Customer Experience and ExpectationsThe financial services industry is therefore going through an unprecedented period. As a result, the financial services industry is experiencing unprecedentedMassive Digital TransformationThe

80%'s Bank AccountsAt least one digital channel will be involved in the financial interactions

Retail Bank of 57%Considering the old system as the biggest obstacle to the digitalization process

Customers of 35%Used online banking services several times during the COVID-19 outbreak

Financial services customers are now interested inContactless Payments, Mobile Banking, Credit Decision Making and Fraud DetectionThere is a general expectation that services such asInstant ExperienceThe financial institutions must therefore realize the digital transformation of their businesses in order to remain competitive in the market. Therefore, financial institutions must realize the digital transformation of their business in order to remain competitive in the market.

In the past, many practitioners have adopted a wrong and inefficient approach to transformation, and they have come to realize that digital transformation is definitely not just aboutAdding a modern website to the traditional infrastructureIt's as simple as that. To achieve the speed of service that customers expect, financial institutions must have a clear understanding of what they are doing.Modernization of the entire software ecosystemThese include the all-importantData LayerThe

RequirementsReal-time performance and high scalabilityThe data layer is the only way to satisfy the contemporary consumer's need for an interactive experience.

Financial institutions can useModern Data ModelingContinued business reorganization. Some businesses in the financial sector (e.g.Fraud Detection) is now available throughArtificial Intelligence, Machine Learning, Fast Graphics and Instant SearchThe technology will be reconfigured.

The hope is to gain a competitive edge and toShorten time-to-marketBusinesses that are not in a position to do so can do so through theCloud DeploymentBuild applications faster.

Financial institutions need a whole new set of capabilities to meet the growing demands of today's financial services customers.Redis Enterprise Providing multiple data models with real-time performance and reliability in any environment, it is designed to help organizations toMaximize the value of its data layerThe

Redis Enterprise OwnershipLinear ExpansionandZero downtimefeatures that provide reliablehigh throughputandSub-millisecond latency. itsNo Shared Cluster ArchitectureThroughAutomatic Failover Mechanismand the configurableDurability and Disaster Recovery OptionsThis ensures fault tolerance in the face of all levels of disaster.

Case Study: Deutsche Börse Realizes High-Speed Data Processing with Redis Enterprise

Deutsche Börse is required to assure the regulators and clients that the systemThroughput and Latency PerformanceRedis Enterprise provides strong support for this.

--Maja Schwob, Head of Data IT, Deutsche Börse

Redis Enterprise SupportInstant Search, Graphics, Event StreamingandAI/ML Modeling ServicesThe capabilities are suitable for applications such asFraud Detection, Wealth Management, Quantitative Tradingand other innovative solutions in a variety of application scenarios.

Case Study: Redis Enterprise Enables Simility to Realize Real-Time Fraud Detection Service

Simility is a service from PayPal that combinesMachine Learning and Human AnalyticsSimility is a cloud-based fraud detection service. With Redis Enterprise processing billions of transactions per day, Simility can deliver fraud detection faster than ever before. 30% Introducing new features and improving overall performance by nearly 90%The

Redis Enterprise as aCustody ServicesIt is available on all major cloud provider platforms, helping organizations to launch new products more quickly and strengthen compliance management.

for example Multi-live Geographic Distributionand other features that allow applications to be deployed globally while providingLocal Level Delayed ExperienceThis makes cloud applications easier to adopt and, in any case, more efficient to use.Maintaining business continuityThe

KnowBe4 為企業應對香港《關鍵基礎設施保護條例》提供了化繁為簡的解決方案。面對第 24 條與第 25 條的嚴格挑戰,它將難以量化的「人為風險」轉變為可追蹤的實戰數據,不僅彌補了傳統評估的盲點,更為年度審核提供了證明控制措施「有效運作」的鐵證。透過自動化報告與持續演練,企業能在大幅降低安全風險的同時,輕鬆滿足監管要求,實現從「被動合規」到「主動防禦」的關鍵轉型。

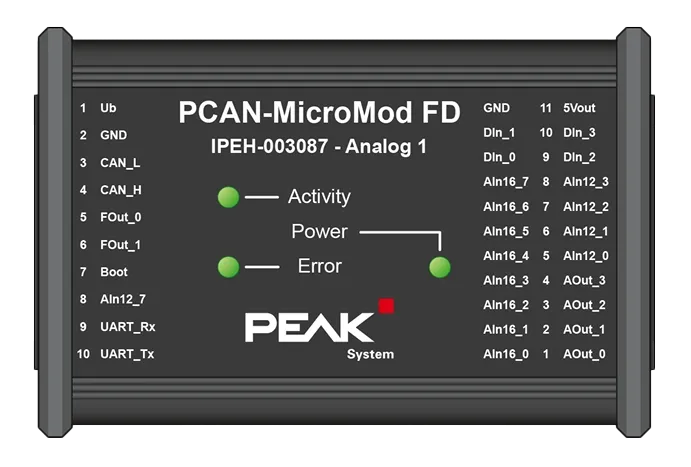

安鵬精密於實際 NVH 路測中,透過虹科 PCAN-MicroMod FD,將車輛 CAN / CAN FD 訊號即時轉換為類比電壓,無需二次開發即可完成訊號同步,低成本整合既有 NVH 資料採集系統。

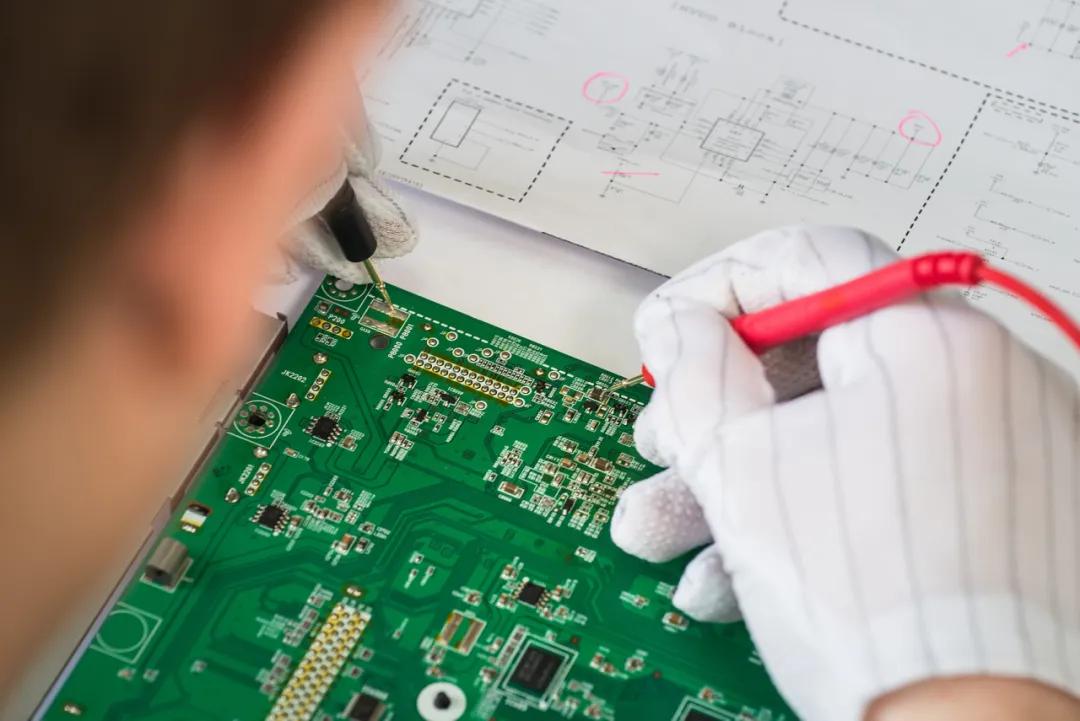

虹科結合 AR 智慧眼鏡與 AI 辨識技術,打造標準化 PCB 質檢工作流程,整合 MES、ERP、AOI 系統,降低漏檢率、提升良率,加速電子製造數位化升級。