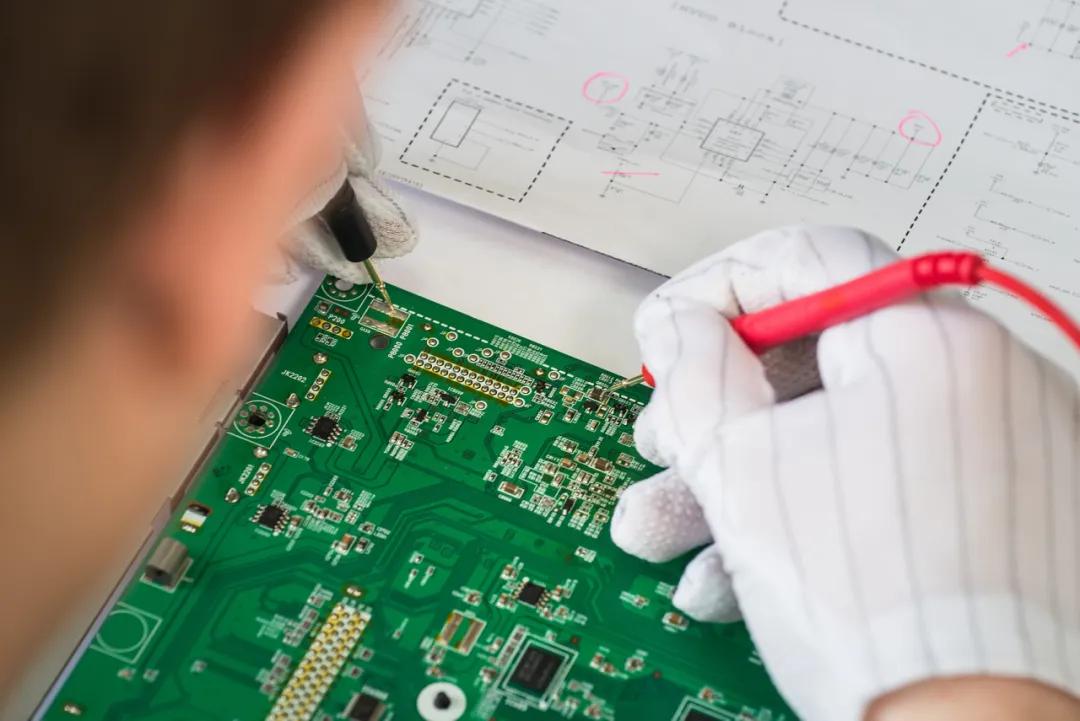

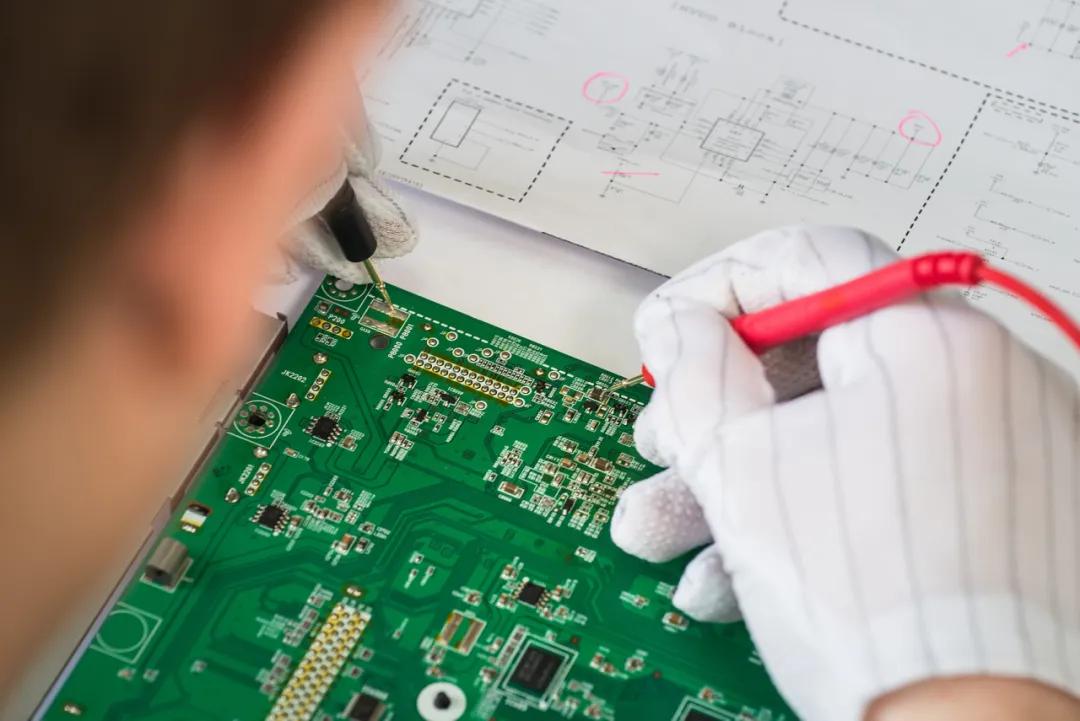

【虹科方案】AI+AR 重塑 PCB 質控流程|虹科 AR 智慧質檢解決方案

虹科結合 AR 智慧眼鏡與 AI 辨識技術,打造標準化 PCB 質檢工作流程,整合 MES、ERP、AOI 系統,降低漏檢率、提升良率,加速電子製造數位化升級。

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Today, as financial business becomes fully online, the business boundaries of financial institutions continue to expand, but fraudulent behavior has also become highly organized, hidden and intelligent. Whether it is credit fraud, money laundering networks, or the penetration of black industry groups into account systems, they are no longer simple single-point events, but complex networks interwoven by multi-level relationship structures.

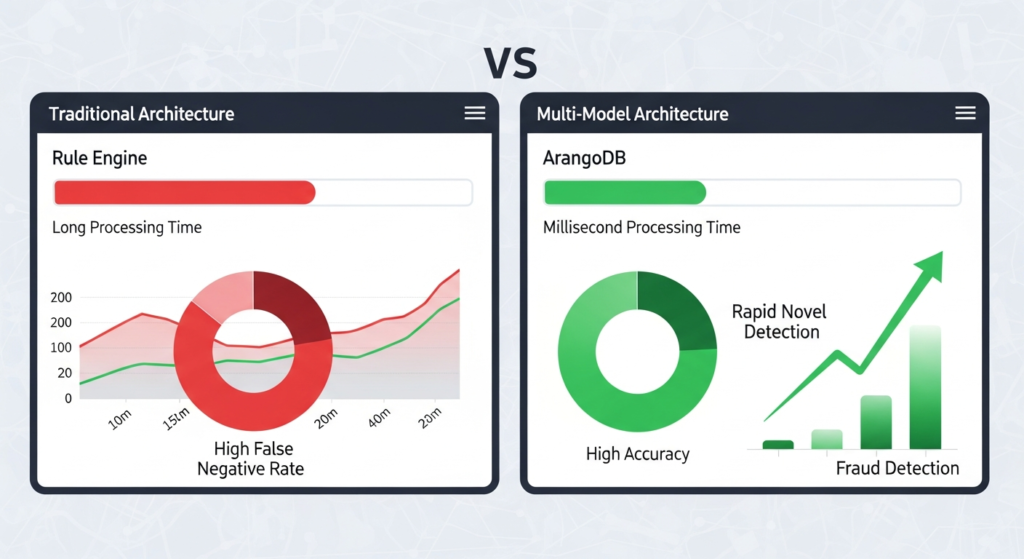

The traditional risk control system of "Rules + Threshold" has become ineffective in the face of these complex fraudulent behaviors. The industry urgently needs to shift from simple rule-based defense to in-depth relationship insights through new technological means.

As fraudulent practices evolve, financial institutions face three core challenges to their existing risk control frameworks:

On the surface, many frauds appear to be discrete and isolated, and each transaction may appear "reasonable" when viewed in isolation. In reality, however, they are often linked by hidden relationships such as shared devices, addresses, contacts, bank cards or payment routes. Traditional risk control is unable to view the full picture from a "relationship perspective", making it impossible to detect the syndicated fraud networks that hide behind normal transactions.

Traditional risk control adopts the strategy of "blocking and defending" by setting up rules, triggering alerts, and manually double-checking the detection. However, while this approach relies on experience and hindsight, fraud syndicates tend to iterate their tactics ahead of time, creating an ongoing "cat and mouse game". The rule base is getting bigger and bigger, but it is still difficult to cope with the rapidly evolving new types of fraud.

Data such as customer information, transaction flow, device fingerprints and channel behavior are often scattered in different systems and silos. To make accurate judgments within milliseconds, a risk control system needs the ability to manage heterogeneous data from multiple sources in a unified manner. The current cross-data modeling analysis is not only time-consuming and complex, but also costly to integrate.

While Graph Analytics has become a core technology for identifying potential connections and tracking capital paths over the past few years, simple graph databases are limited in storing large amounts of transaction details. The industry trend is moving away from "faster rule making" towards "unified, real-time data views".

ArangoDB Being a native Multi-Model database, it supports both the Graph,Document cap (a poem) Vector The data becomes the ideal base for building an integrated anti-fraud system of "Relationship + Behavior + Pattern Recognition".

Financial fraud is often an organized, collaborative effort. arangoDB's native graph model can identify complex networks of relationships in milliseconds, solving the following key problems:

Group fraud identification: Find out if devices, payment pipes, or funding links are shared between multiple accounts.

Intermediary/Center Node Positioning: Use graphical algorithms to identify potential manipulators or "money transfer hubs".

Money Laundering Chain Analysis: Trace the transaction path to identify unusually complex loop structures.

Graph structure alone is not enough to support decision making, risk control requires rich context, and ArangoDB's file model supports JSON format natively, which is highly flexible:

Flexible storage details: No need for complicated table structure design, naturally adapts to expanding fields, no need to relocate the library.

Multi-source data unification: Easily integrate semi-structured data such as device fingerprints and user traces.

Efficient Enquiry: A single AQL statement can fulfill the hybrid query of "transaction+relationship+behavior" without the need of cross-library JOIN.

ArangoDB's most competitive advantage is that it can span and merge multiple data models in a single query, dramatically simplifying architectural complexity:

Logic Example: Also query "whether it is a fraud ring (graph)", "past week's flow of funds (file)" and "whether the behavioral pattern is similar to known fraud (vector)".

Architectural Advantage: The task that traditionally requires three systems (graph database + file database + vector database) is accomplished in milliseconds on one platform.

In actual cases of overseas financial institutions, the adoption of multi-model + graph analytics framework has brought significant business enhancement:

3-10 times faster recognition: Risk control teams are able to quickly identify emerging fraud syndicates from a relational perspective and no longer passively rely on rule-based patching.

The accuracy rate has improved significantly: Graphical modeling complements relationship risk, reduces underreporting, and makes hidden anomalous transactions invisible.

Millisecond response to risk control decisions: Thanks to the native decentralized and unified query architecture, system latency is dramatically reduced.

Maintenance costs have been significantly reduced: Simplifies the technology stack and eliminates the need to maintain multiple distributed database systems.

In the face of evolving fraudulent practices, financial institutions can no longer afford to tinker with their rules. True anti-fraud enhancement requires a relationship-structuring approach that is Chart ModelThe newest and most advanced technology in the world is a new technology that can record behavioral details. file model, as well as the ability to recognize pattern similarities in Vector SearchThe

ArangoDB helps organizations move from "event judgment" to "relationship insight" and from passive defense to active identification through multi-model fusion. This not only means earlier detection of fraudulent groups, but also more stable model results and lower infrastructure costs. From data silos to integrated risk control will be the mainstream direction for upgrading the financial security framework in the future.

虹科結合 AR 智慧眼鏡與 AI 辨識技術,打造標準化 PCB 質檢工作流程,整合 MES、ERP、AOI 系統,降低漏檢率、提升良率,加速電子製造數位化升級。

深入解析虹科 GNSS 模擬器如何支援無人機整機測試,涵蓋多星座 GNSS 仿真、RTK 公分級定位、抗干擾測試與多感測器融合驗證,助力高效、安全的 UAV 研發。

增材製造(PBF-LB/M)中的高精度過程監控與誤差檢測,虹科 iDS USB3 工業相機助力粉末層、再熔化層與動態飛濺監控,提升部件品質與研發效率,適用航空航天、醫療、汽車等行業。